activepr.online

News

Transfer Card Balance To New Card

A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. Transfer Fees: Some credit card issuers charge a fee to transfer balances from another lender. · Credit Score: Not everyone qualifies for promotional interest. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. A balance transfer is a transaction that enables you to move existing debt to a new credit card. The purpose of a balance transfer is to get a lower interest. 1. Check your current balance and interest rate · 2. Pick a balance transfer card that fits your needs · 3. Read the fine print and understand the terms and. A balance transfer is when you move debt from one credit card to another credit card. This is done by moving a credit card balance from one card to a new card. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a. A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower interest rate. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. Transfer Fees: Some credit card issuers charge a fee to transfer balances from another lender. · Credit Score: Not everyone qualifies for promotional interest. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. A balance transfer is a transaction that enables you to move existing debt to a new credit card. The purpose of a balance transfer is to get a lower interest. 1. Check your current balance and interest rate · 2. Pick a balance transfer card that fits your needs · 3. Read the fine print and understand the terms and. A balance transfer is when you move debt from one credit card to another credit card. This is done by moving a credit card balance from one card to a new card. A balance transfer moves a balance from a credit card or loan to another credit card. Transferring balances with a higher annual percentage rate (APR) to a.

Choose from your Chase cards to see if you have eligible balance transfer offers. Enter amount. Select an offer, then enter the amount and the credit card to. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. You may pay a balance transfer. Discover balance transfer credit card offers can help you pay off credit card balances with a low-intro APR balance transfer. Discover U.S. News' picks for the best balance transfer cards. Find the best 0% APR and low interest card offers to save money and pay off your debt. Step 1: Check your current balance and interest rate · Step 2: Choose the right credit card for you · Step 3: Apply for a credit card · Step 4: Transfer the. Intro balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for transfers completed within 4 months of account opening. After. Choose one or more cards with the highest rates and transfer those balances first, if the new credit limit permits. · Read the small print and note the balance. A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate. A balance transfer is when you shift debt from one (or many) cards to another card. Typically, you would transfer to a credit card with a lower interest rate. A balance transfer is when you move the balance of one or multiple credit cards or other loans to a new or existing credit card account. It's a smart way to. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional, low or. Balance Transfer Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months · $0. ; Chase Freedom Unlimited credit card · Earn a. Balance Transfer Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months · $0. ; Chase Freedom Unlimited credit card · Earn a. A balance transfer credit card allows you to transfer debt from one credit card to another card. A balance transfer lets you transfer debt to a credit card. It may help you consolidate debt, simplify payments and potentially pay less interest. In addition. You can transfer balances between cards, but there is almost always a 3 or 4% fee attached to the balance transfer. There is no situation where. To request a Balance Transfer by phone, call the number on the back of your card. What's next?

Home Insurance Pitbull Friendly

Insurance companies that may insure otherwise black-listed dog breeds include Liberty Mutual, Nationwide, Amica, State Farm, Chubb, USAA (for military members. There are many rental properties in Durham that accept some types of cats, dogs or other animals. Finding a pet-friendly apartment or rental home. A home insurance policy can protect you from liability incidents caused by your pets. Find out why liability insurance is important and if you're covered. $35 pet rent per month per home. Dog restrictions: no weight restrictions. The following breeds are restricted: Akita, Chow, Doberman Pinscher, Pitbull. ATX Pit Bull-Friendly Boarding, Pet Sitting and Doggy Daycare. These are Pit-Friendly Home Insurance Companies. If your current insurance policy. Dogs that are typically on this list include breeds like Pitbulls, Rottweilers, and Dobermans. If a homeowners insurance company has a breed on its ineligible. Pit bull-friendly home insurance options · Allstate · Amica · Chubb · Nationwide · State Farm · USAA. Unless your policy comes with pet-specific endorsements, most insurance companies will deny any coverage for damages inflicted by pets on your property or those. A list of pitbull-friendly homeowners insurance companies · Liability coverage. Liability coverage comes in handy, for example, if you are sued by someone who is. Insurance companies that may insure otherwise black-listed dog breeds include Liberty Mutual, Nationwide, Amica, State Farm, Chubb, USAA (for military members. There are many rental properties in Durham that accept some types of cats, dogs or other animals. Finding a pet-friendly apartment or rental home. A home insurance policy can protect you from liability incidents caused by your pets. Find out why liability insurance is important and if you're covered. $35 pet rent per month per home. Dog restrictions: no weight restrictions. The following breeds are restricted: Akita, Chow, Doberman Pinscher, Pitbull. ATX Pit Bull-Friendly Boarding, Pet Sitting and Doggy Daycare. These are Pit-Friendly Home Insurance Companies. If your current insurance policy. Dogs that are typically on this list include breeds like Pitbulls, Rottweilers, and Dobermans. If a homeowners insurance company has a breed on its ineligible. Pit bull-friendly home insurance options · Allstate · Amica · Chubb · Nationwide · State Farm · USAA. Unless your policy comes with pet-specific endorsements, most insurance companies will deny any coverage for damages inflicted by pets on your property or those. A list of pitbull-friendly homeowners insurance companies · Liability coverage. Liability coverage comes in handy, for example, if you are sued by someone who is.

Additionally, some companies, like The Hanover offer protection specifically geared toward your pets. For instance, pet injury coverage can provide up to $2, Pet owners – dogs, cats, birds, rabbits, reptiles, etc. · Dog breed deemed aggressive including Pit Bulls, Rottweilers, German Shepherds, and more · Animals with. Renting with Big Dogs (and Pit bulls!) Here we have listed third party information on Pet Friendly Housing Searches, Renter's Insurance, Pet-Proofing Your. Einhorn Insurance provides home, renter, condo and liability insurance regardless of your dog's breed. As proud Pit Bull owners, we could not imagine having. Pets may be covered under the liability limits of the owner's home insurance policy, typically between $, and $, Some pet owners choose to. Embrace pet-friendly policies without worry. Our animal liability insurance solutions give landlords peace of mind and protects their investment. Unfortunately, many pit bull owners are faced with a type of breed bias that comes in the form of insurance companies that will not cover their dogs under their. Pit Bull Terriers · Puppy Mills · Shelter and Rescue Work · Wildlife · General Pets · Pet Loss · Pet Safety and Emergencies · Pet-Friendly Housing and Finances. State Farm is working with Trupanion, a leader in high-quality insurance for cats and dogs, to help protect your pet from new and unexpected illnesses and. Keep searching! Some insurance companies are known for insuring pit bulls and other hard-to-insure dog breeds. Allstate, Farmers, Nationwide, USAA, and State. The only way to know for sure how your pet will affect coverage is to talk with your insurer. Be honest with your insurance provider when discussing your pet. For starters, any claim you file could be denied if your dog bites or injures someone and your insurer didn't previously know about your pet. Your insurer may. Insurance is one of the top reasons why potential adopters say they can't consider dogs perceived as pit bulls. Generally, most insurance companies define a “pet” as a dog or cat. Exotic pets may not enjoy the same coverage. Does homeowners insurance cover pet damage? If. Pitbull-Friendly Home Owners Insurance. Companies that will insure Pit Bull Type Dogs (most work on a case by case basis). Pit bulls include the American Pit Bull Terrier, the American Staffordshire Terrier, the Staffordshire Bull Terrier and any cross-breeding of those dog types. As proud Pit Bull owners and advocates, we are especially sensitive to this issue. We couldn't imagine being discriminated against because our Pit Bulls are. Fortunately, there are pet-friendly insurance companies out there that can provide excellent coverage that allows these large breed dogs to remain safe and. Pet Friendly Insurance Companies · Zumper - Pet friendly apartment search engine · Keep Your activepr.online - Pit Bull friendly insurance companies.

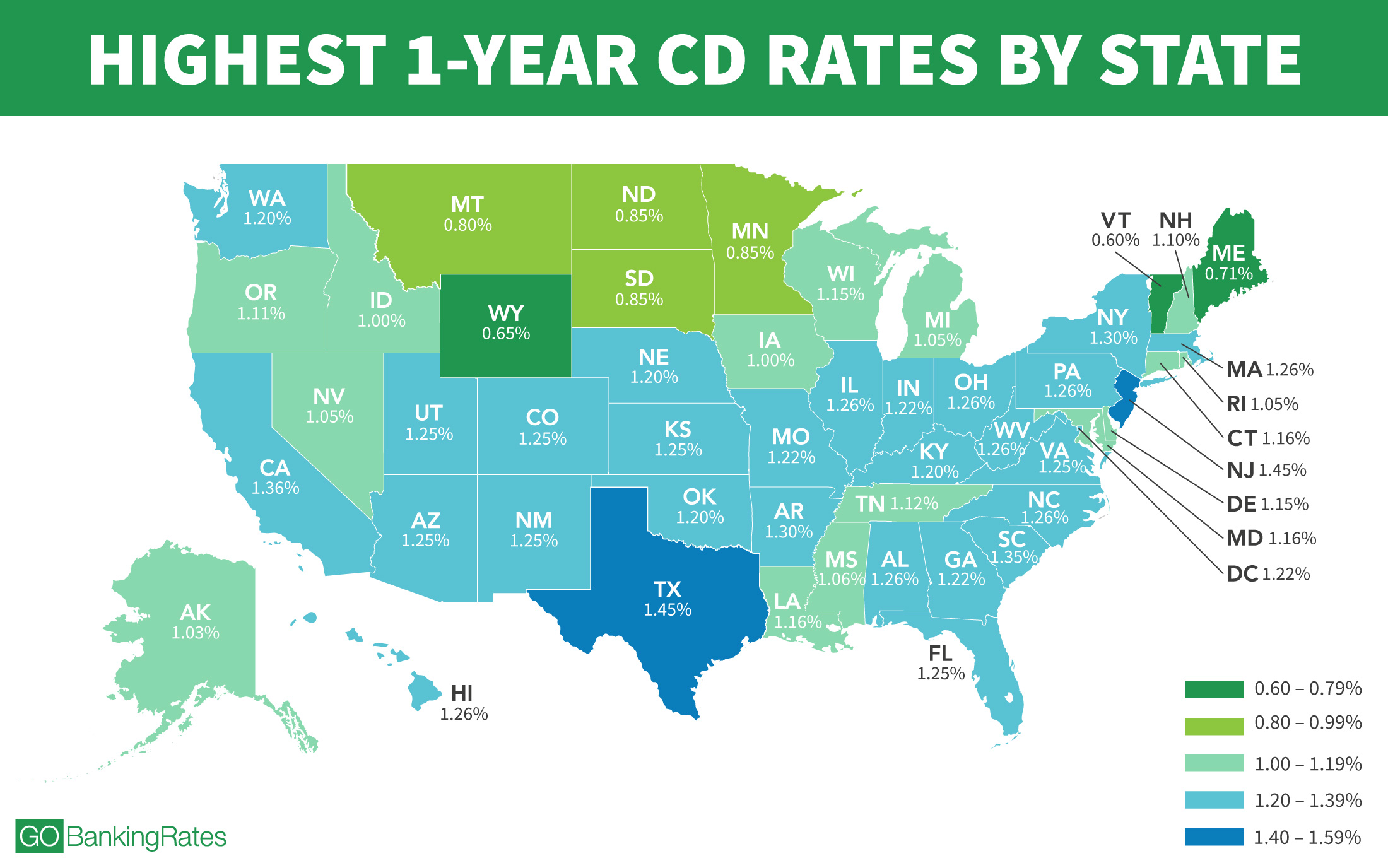

How Much Does A Cd Yield

At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. How often your additional contributions will occur. Your choices are weekly (52 times per year), every other week (26 times per year), monthly, quarterly or. Right now, the national average rate for a one-year CD is %. However, there are many one-year CDs that offer APYs above 4% and 5%. CD Calculator: See How Much You Could Earn. Use our free CD calculator below yield savings accounts (Raisin does not). Tips for Using Certificates of. Certificate of Deposit (CD) — Rates ; N/A, %, % ; N/A, %, %. Bump-Up CD 24 Months. · Earn with confidence. ; Certificate of Deposit (CD) · · Lock in for higher rates. ; No-Penalty CD 11 Months. · Flexible and. Annual Percentage Yield (APY). From % to % APY · Terms. From 3 months to 5 years · Minimum balance. None · Monthly fee. None · Early withdrawal penalty fee. In the first two months of , the average 1-year online CD yield had its largest two-month decline since May-June The average decreased basis. In comparison, the average one-year CD yield is below 1% in It gradually increased in , reaching more than 5% in 20due to rising. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. How often your additional contributions will occur. Your choices are weekly (52 times per year), every other week (26 times per year), monthly, quarterly or. Right now, the national average rate for a one-year CD is %. However, there are many one-year CDs that offer APYs above 4% and 5%. CD Calculator: See How Much You Could Earn. Use our free CD calculator below yield savings accounts (Raisin does not). Tips for Using Certificates of. Certificate of Deposit (CD) — Rates ; N/A, %, % ; N/A, %, %. Bump-Up CD 24 Months. · Earn with confidence. ; Certificate of Deposit (CD) · · Lock in for higher rates. ; No-Penalty CD 11 Months. · Flexible and. Annual Percentage Yield (APY). From % to % APY · Terms. From 3 months to 5 years · Minimum balance. None · Monthly fee. None · Early withdrawal penalty fee. In the first two months of , the average 1-year online CD yield had its largest two-month decline since May-June The average decreased basis. In comparison, the average one-year CD yield is below 1% in It gradually increased in , reaching more than 5% in 20due to rising.

1-year CD yield: percent APY · 3-year CD yield: percent APY · 5-year CD yield: percent APY.

What are today's CD interest rates? · 1-year CD yield: % APY · 3-year CD yield: % APY · 5-year CD yield: % APY. The reviews are in. People like it here. We think you will, too. Average Rating. Typically CDs have monthly compounding interest. Some CDs offer daily compounding interest. The more frequently it compounds, the faster a CD will grow. Does. A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from INOVA Federal Credit Union for a 5-month term. CDs are similar to savings accounts, but they are set to a fixed term (usually ranging from one month to ten years) and a fixed interest rate. It is expected. What types of CDs does TowneBank offer? · Traditional CD · Month Add-on CD · Jumbo CD. Annual percentage yield (APY) This is the effective annual interest rate earned for this CD. A CD's APY depends on the frequency of compounding and the interest. CDs are a great way to make your money grow, so long as you have clear long- or short-term financial goals in mind for your money. With competitive rates of. How Much Do CDs Pay? As of April 17, , national CD averages range from % (1-month term) to % (5-year term), according to the Federal Deposit. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Personal CD Rates ; 1 year, %, % ; 15 month, %, % ; 18 month, %, % ; 2 year, %, %. CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). CDs: How they work to grow your money. Learn how this savings tool works and when it could work well for you. Read the article. The Marcus 5-Year High-Yield CD rate is % Annual Percentage Yield. The 5-year CD could be useful for longer-term savings goals. APY as of August 25, Interest rate and APY are fixed. You'll know exactly how much you'll earn on Day 1 by locking in your rate. ; Compounding daily, depositing monthly. Your. CD Calculator: See How Much You Could Earn. Use our free CD calculator below yield savings accounts (Raisin does not). Tips for Using Certificates of. CDs: How they work to grow your money. Learn how this savings tool works and when it could work well for you. Read the article. The average three-month CD yield rose from %, near-nothing, in December to % in May according to the FDIC, with the most competitive rates on. How CDs work In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate.

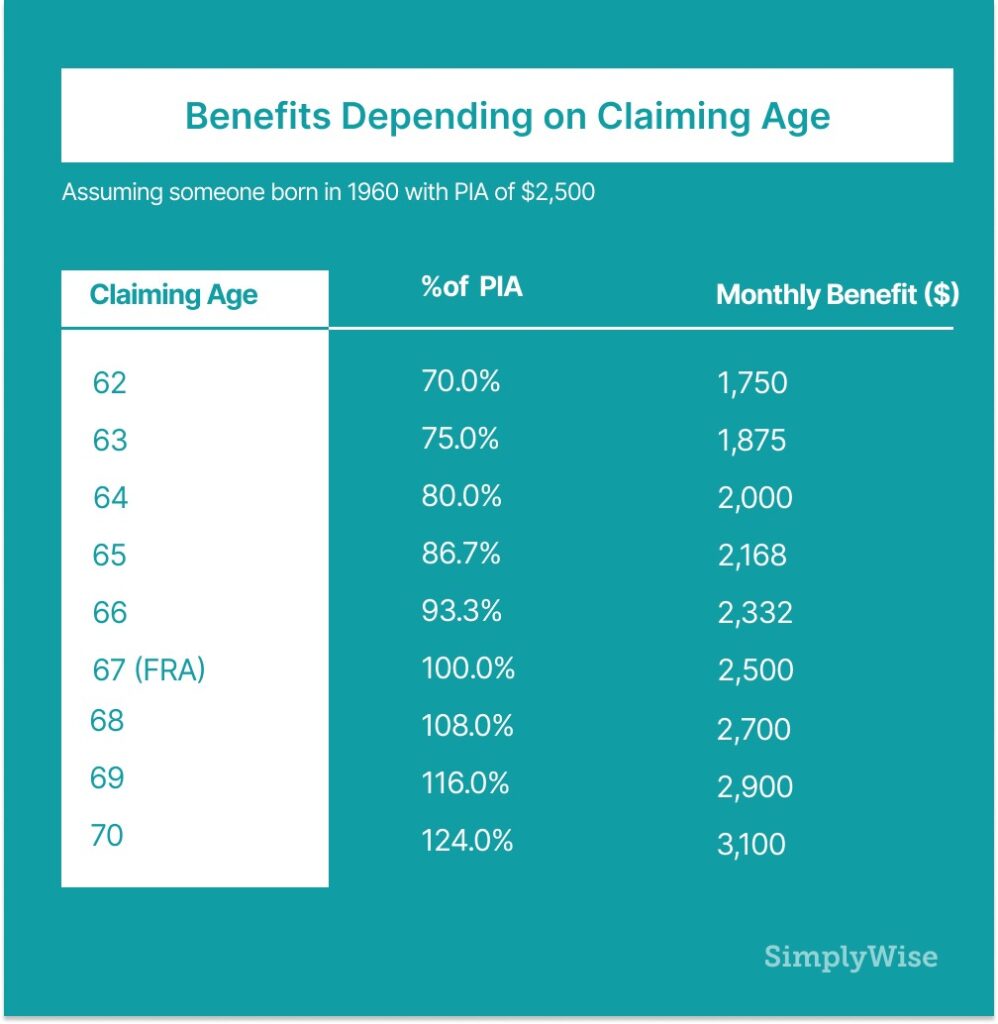

Collecting Ss At 62

But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each. While retirees are technically able to start collecting reduced benefits at age 62, individuals (with a full retirement age of 67) who start collecting at age. If you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. For people born in , full retirement age is 66 years 8 months. Filing at 62, 56 months early, permanently reduces your monthly benefit by percent. If. Regardless of your full retirement age, the earliest you can start receiving Social Security retirement benefits will remain age 62, and the latest you can. If you retire with 30 or more years of service, your benefit will not be reduced as a result of retiring before age If you begin collecting retirement benefits at age 62, each monthly benefit check will be 25% to 30% less than it would be at full retirement age. Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70); Calculate what payments you would receive based on your. Early retirement benefits will continue to be available at age 62, but they will be reduced more. When the full-benefit age reaches 67, benefits taken at age But, if you claim early retirement benefits at age 62 (or 63, 64, 65, or 66) and continue to work, be aware that the money you earn over a certain amount each. While retirees are technically able to start collecting reduced benefits at age 62, individuals (with a full retirement age of 67) who start collecting at age. If you start taking Social Security at age 62, rather than waiting until your full retirement age (FRA), you can expect a 30% reduction in monthly benefits. For people born in , full retirement age is 66 years 8 months. Filing at 62, 56 months early, permanently reduces your monthly benefit by percent. If. Regardless of your full retirement age, the earliest you can start receiving Social Security retirement benefits will remain age 62, and the latest you can. If you retire with 30 or more years of service, your benefit will not be reduced as a result of retiring before age If you begin collecting retirement benefits at age 62, each monthly benefit check will be 25% to 30% less than it would be at full retirement age. Estimate your retirement benefits based on when you would begin receiving them (from age 62 to 70); Calculate what payments you would receive based on your. Early retirement benefits will continue to be available at age 62, but they will be reduced more. When the full-benefit age reaches 67, benefits taken at age

While you can start as early as age 62, waiting a few years or until you reach your full retirement age can substantially increase the amount you receive over. Social Security retirement benefits can begin as early as age 62, as late as age Are there advantages or disadvantages of taking retirement benefits early? You must be age 62 or older. If my ex-spouse remarried and the new spouse is collecting benefits based on their record, will that reduce my benefits? If you retire at the MRA with at least 10, but less than 30 years of service, your benefit will be reduced by 5 percent a year for each year you are under You may be eligible to collect Social Security as early as 62, but waiting until age 70 yields greater benefits for most people. Here's help on how to. Yes, someone receiving retirement can apply for SSDI benefits if they elected to take early retirement and are receiving a reduced amount. Step 1: Explore how the age you start collecting Social Security affects your retirement benefits Estimated benefits. You can begin collecting your Social Security benefits as early as age 62, but you'll get smaller monthly payments for the rest of your life if you do. Even so. You can retire and collect Social Security benefits any time after age If you decide to start taking benefits before your full retirement age, your. Some people believe you have to start claiming Social Security benefits at age That's a myth: 62 is the earliest age you can claim your benefit. If you can put off taking SS until you no longer want to work, you'll get significantly larger payments, and a more comfortable retirement. And. But, your Social Security benefits are reduced by 30% if you retire at That means you will receive just 70% of your full retirement benefit every month for. For example, if you start collecting benefits at age 62 when your full retirement age is 66, your monthly benefit will be 71% to 73% of your full-age benefit. You can start collecting Social Security as early as age 62 – but that could permanently reduce your benefits by up to 30%.1 The amount you receive. The earliest age you can collect Social Security benefits is If you collect earlier than your full retirement age, you will receive a reduced benefit. This. Although Social Security offers the option to draw benefits as early as age 62, the penalty for doing so before your full retirement age (FRA) can be high. Earliest you can take SS is age This is a reduced benefit from your full retirement age, which is like 67 and some months. Every year. As the Social Security Administration (SSA) points out, it is perfectly fine to work full time and collect Social Security when you turn the eligible-to-. The SSA website provides estimates for how much you'll collect if you start receiving benefits at age 62, your full retirement age (FRA) (between 66 and 67). Full Retirement Age One of the most important things to understand about claiming Social Security benefits is the relationship between claiming early and.

What Is Twitter Trading At

Company profile page for Twitter Inc including stock price, company news, executives, board members, and contact information. Traders and investors with access to a Bloomberg terminal can use TWTR to build a search filter for updates from Twitter (or tweets). Users can filter content. View live Twitter Inc chart to track its stock's price action. Find market predictions, TWTR financials and market news. What is really driving inflation and what are the implications for financial markets? Hear from Indrani De and John Dioufas, in LSEG's first episode of Macro. stock price graph to view Verizon stock performance and trading volume at various time intervals twitter · instagram. Follow Inside Verizon. twitter. Find the latest Twitter Inc financial news and headlines to keep up with Trading Platform · Brokerage integration · Partner program · Education program. Twitter, Inc. (TWTR) PT Raised to $54 at UBSUBS analyst Lloyd Walmsley raised the price target on Twitter, Inc. (NYSE: TWTR) to $ (from $) while. Host of @madmoneyoncnbc and I run the CNBC Investing Club. Follow along and join my mailing list at activepr.online Your official Government of Canada source for international trade updates. Français: @CommerceCanada. Company profile page for Twitter Inc including stock price, company news, executives, board members, and contact information. Traders and investors with access to a Bloomberg terminal can use TWTR to build a search filter for updates from Twitter (or tweets). Users can filter content. View live Twitter Inc chart to track its stock's price action. Find market predictions, TWTR financials and market news. What is really driving inflation and what are the implications for financial markets? Hear from Indrani De and John Dioufas, in LSEG's first episode of Macro. stock price graph to view Verizon stock performance and trading volume at various time intervals twitter · instagram. Follow Inside Verizon. twitter. Find the latest Twitter Inc financial news and headlines to keep up with Trading Platform · Brokerage integration · Partner program · Education program. Twitter, Inc. (TWTR) PT Raised to $54 at UBSUBS analyst Lloyd Walmsley raised the price target on Twitter, Inc. (NYSE: TWTR) to $ (from $) while. Host of @madmoneyoncnbc and I run the CNBC Investing Club. Follow along and join my mailing list at activepr.online Your official Government of Canada source for international trade updates. Français: @CommerceCanada.

A trading bot to execute trades based on specific mentions of a ticker by a Twitter user - jamesbachini/Twitter-Trading-Bot. Nvidia has become world's 'most important stock,' adding pressure to upcoming earnings report Stock Exchange. Listen and follow the. @moneymoverscnbc. podcast. This paper proves whether Twitter data relating to cryptocurrencies can be utilized to develop advantageous crypto coin trading strategies by way of. Stocks & Retirement: Robinhood Financial Crypto trading: Robinhood Crypto Spending/Debit: Robinhood Money Credit Card: Robinhood Credit Support. This stock is no longer active on Robinhood. Sign up for a Robinhood brokerage account to watch Twitter and buy and sell other stock and options commission-free. Learn how to buy, sell and short Twitter shares with IG. A guide to the history and business model of Twitter and the basics of its shares. on #NYSEFloorTalk to discuss the company's recent rebrand, Onity's mission, and key insights for potential investors. to start off the day's trading session. This course helps you to perform sentiment analysis of twitter data and on news articles to create an intraday trading strategy. Open the Mac App Store to buy and download apps. X 17+. Formerly Twitter. X Corp. Learn the advantages of trading Twitter Stock via CFDs. ⭐ FREE Twitter Stock live quotes, charts with Canadian-regulated broker! As X (formerly Twitter) is no longer a listed company, you cannot invest in its shares. However, there is a range of other related tech stocks such as Meta . Musk bought Twitter in October for $44 billion at his original proposed price of $ per share. Among his first acts as Twitter's owner were to lay off. TRADING ON THE NEW YORK STOCK EXCHANGE. Released: 07 November November 7, NEW YORK, November 7, - Twitter opened for trading today on the New. Twitter, Inc. was an American social media company based in San Francisco, California, which operated and was named for its flagship social media network. Breaking news and analysis on global financial markets Get live markets updates: activepr.online Sign up for newsletters: activepr.online FO Trader #Intraday #Positional. Some portfolio picks and cash trades. Not SEBI registered. Not responsible for any loss. Here to help everyone. The Securities and Exchange Commission (SEC) oversees securities exchanges, securities brokers and dealers, investment X Twitter USAGov Twitter · Youtube. Nathan Reiff has been writing expert articles and news about financial topics such as investing and trading, cryptocurrency, ETFs, and alternative investments. Interestingly, sentiment in tweets from users with fewer than followers that were not retweeted had the greatest impact on future stock returns. A trading.

What Is The Cost Of Cataract Surgery For A Dog

My dog (year-old, female Maltipoo, toy breed) has a cataract and the vet is recommending surgery. The initial estimate is $, plus $ worth of tests. The client and patient will need to return to UTCVM for follow-up visits. These visits are not included in the surgery cost. The cataract surgery recheck. The cost for dog cataract surgery can be between $2, and $4,, with an average cost of around $3, This is one of the more expensive procedures your. Cataract surgery in small animal patients (dogs and cats) is considered a routine ophthalmic operation. The success rate is considered high, at approximately. As we mentioned, the average cost of dog cataract surgery is anywhere from $2, to $4, This cost includes the original exam, testing and diagnostics. Animal Eye Center can provide great information on Cherry Eye, Cataract, and other Dog Surgery Cost. Best service around. Call today! The cost of cataract surgery ranges from $2, to $5, on average, but this can vary depending on the type of surgery, condition of the eye and location. The cost of cataract surgery is significant, especially if the strongly recommended lens prosthesis is applied--typically $1, to $5, per eye. It should. Cataract surgery and lens replacement on both eyes is $9, My internet searches for the cost of this to be $2, - $4, My dog is. My dog (year-old, female Maltipoo, toy breed) has a cataract and the vet is recommending surgery. The initial estimate is $, plus $ worth of tests. The client and patient will need to return to UTCVM for follow-up visits. These visits are not included in the surgery cost. The cataract surgery recheck. The cost for dog cataract surgery can be between $2, and $4,, with an average cost of around $3, This is one of the more expensive procedures your. Cataract surgery in small animal patients (dogs and cats) is considered a routine ophthalmic operation. The success rate is considered high, at approximately. As we mentioned, the average cost of dog cataract surgery is anywhere from $2, to $4, This cost includes the original exam, testing and diagnostics. Animal Eye Center can provide great information on Cherry Eye, Cataract, and other Dog Surgery Cost. Best service around. Call today! The cost of cataract surgery ranges from $2, to $5, on average, but this can vary depending on the type of surgery, condition of the eye and location. The cost of cataract surgery is significant, especially if the strongly recommended lens prosthesis is applied--typically $1, to $5, per eye. It should. Cataract surgery and lens replacement on both eyes is $9, My internet searches for the cost of this to be $2, - $4, My dog is.

Cataract surgery at Animal Eye Specialists is done routinely and comes with after hours emergency support if needed. Make our eye institute your choice for. FIXED-FEE SURGERY PRICING · GRADE 1 $1, Eye Removal · GRADE 2 $1, Superficial Keratectomy, grid keratotomy and placement of a third eyelid flap (TEF). Cataract surgery can be performed in dogs to remove the cataract and restore vision. What's included in the cost of cataract surgery at the Vet Vision Center? What are the costs of the surgery? The estimated cost of the initial eye exam and about cataract surgery or your pet's eyes. Cataract Surgery. Cataract Removal · Unilateral: $3,$ · Bilateral: $3,$4, *Dependent on candidacy for IOL (Intraocular Lens) in one/both eye. The cost for dog cataract surgery can be between $2, and $4,, with an average cost of around $3, This is one of the more expensive procedures your. The success rate of cataract surgery is around % in most cases. The caring team at Animal Eye Care take great delight in restoring the vision of blind. How Much Is Cataract Surgery For Dogs? The cost of cataract surgery for dogs averages $2,, This estimate includes the preliminary examination, ERG and. The success rate of uncomplicated cataract surgery is approximately percent. This success rate may vary depending upon the overall health of the affected. Cataract surgery · Cataracts can only be treated by surgically removing them. · Your dog has the best chance of a successful surgery if they are generally healthy. It will be done by a veterinary ophthalmologist, not your regular vet. I worked for one for a couple years & we did a lot of cataracts. HOW MUCH DOES DOG CATARACT SURGERY COST? Has your dog been diagnosed with cataracts? If so, are you worried about the cumbersome cost of. Cataract surgery for dogs can help your pup combat blurry and cloudy vision due to cataracts. Sometimes, decreased eyesight can lead to total blindness. Cataract Surgery in Dogs · Deep Corneal Ulceration · Indolent Corneal Ulceration We would expect you to settle the cost of the consultation and treatment. The long-term success rates reported in dogs following uncomplicated cataract surgery range from %. Successful surgery is defined as a visual animal with. How Much Is Cataract Surgery For Dogs? The cost of cataract surgery for dogs averages $2,, This estimate includes the preliminary examination, ERG and. In the majority of cases, animal cataract surgery is elective. It can dramatically affect the quality of your pet's life, but it is not a life-saving surgery as. Cost Of Canine Cataract Surgery. There is no set cost for canine cataract surgery. How much cataract surgery for your dog will cost depends on these factors. Cataract surgery and general eye treatment prices Payment is required at the end of your consultation or when collecting your pet after a surgical procedure. Canine Cataract Surgery Variable Costs · Anesthesia costs fluctuate based upon the size of the dog. · Costs will vary based upon whether the surgery will include.

Basic Investment Portfolio

:max_bytes(150000):strip_icc()/TermDefinitions_FinancialPortfolio-6ac851d5ad8f44dcb9a42f937856c22e.png)

An investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash and cash equivalents, and commodities. Understand that there are risks with investing. · Be realistic in your expectations. · Take a long term approach. · Diversify your investments. · Diversify your. This is a step-by-step approach to determining, achieving and maintaining optimal asset allocation. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Before buying shares in a mutual fund, read the prospectus carefully. The prospectus contains information about the mutual fund's investment objectives, risks. Portfolio construction is the process of understanding how different asset investment management and investment advisory services (“Investment Services. Identify your investing goals; Weigh your comfort with investment risk; Understand your investment time horizon; Agree on an optimal portfolio mix; Ensure. Discover tools and resources to help you find investments and manage your portfolio with Merrill Edge Self‑Directed. · Search for Ideas · Evaluate individual. A portfolio is a collection of assets—stocks and bonds, real estate or even cryptocurrency—owned by one person or entity. An investment portfolio is a set of financial assets owned by an investor that may include bonds, stocks, currencies, cash and cash equivalents, and commodities. Understand that there are risks with investing. · Be realistic in your expectations. · Take a long term approach. · Diversify your investments. · Diversify your. This is a step-by-step approach to determining, achieving and maintaining optimal asset allocation. Whenever you check your asset allocation, make sure your portfolio remains diversified enough to maintain a risk level you're comfortable with for both short-. Before buying shares in a mutual fund, read the prospectus carefully. The prospectus contains information about the mutual fund's investment objectives, risks. Portfolio construction is the process of understanding how different asset investment management and investment advisory services (“Investment Services. Identify your investing goals; Weigh your comfort with investment risk; Understand your investment time horizon; Agree on an optimal portfolio mix; Ensure. Discover tools and resources to help you find investments and manage your portfolio with Merrill Edge Self‑Directed. · Search for Ideas · Evaluate individual. A portfolio is a collection of assets—stocks and bonds, real estate or even cryptocurrency—owned by one person or entity.

Know your objectives · Choose the right level of risk · Select your investments within each asset · Rebalance your portfolio and review your strategy. Information and resources from the Washington Department of Financial Institutions. By diversifying investments across stocks and bonds and among sectors and countries, an investor can reduce overall portfolio volatility and help guard against. A mutual fund is a type of investment made up of a pool of money collected from many investors to invest in securities like cash, bonds, stocks and other assets. Portfolios can include a variety of different assets, such as stocks, bonds, cash, and real estate. The goal of an investment portfolio is to generate returns. Portfolio - A collection of investments owned by one organization or individual, and managed as a collective whole with specific investment goals in mind. Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. The process of determining which. A portfolio's meaning can be defined as a collection of financial assets and investment tools that are held by an individual, a financial institution or an. Choosing the right portfolio that aligns with your financial goals, risk tolerance, and investment horizon is essential. Also, regularly monitoring your. A well-diversified financial portfolio should include stocks, bonds, other assets and of course, cash. Get to know these different types of investment tools and. portfolio, but skews toward the profitability and investment This is a great place for beginner and advanced investors to share knowledge! Your investment portfolio refers to all the investments you own, including the stocks Having a balanced portfolio is essential to helping you manage. The primary objective of an investment portfolio review is to ensure that your portfolio is well-positioned to achieve your long-term financial goals while. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. Usually expressed on a percentage basis, your asset allocation is what portion of your total portfolio you'll invest in different asset classes, like stocks. For years, many financial advisors recommended building a 60/40 portfolio, allocating 60% of capital to stocks and 40% to fixed-income investments such as bonds. Or, if you'd rather manage individual investments, you might want to create a short-term CD or bond ladder—a strategy in which you invest in CDs or bonds with. Allocate your investments across different asset classes such as stocks, bonds, real estate, and commodities. · Within each asset class, invest. Diversify your portfolio The more bonds and stocks you own, the smaller the impact each one individually has on your overall portfolio, which can lower your.

Charles Schwab Cryptocurrency Trading

How does one invest in bitcoin on the Schwab platform? Can you buy a bitcoin or is there mutual funds or ETF for bitcoin? trading platforms on the market. Screen shot of Charles app While Charles Schwab offers most investment options, cryptocurrency isn't one of them. ETFs at Charles Schwab & Co., Inc. ("Schwab") which are U.S. exchange-listed can be traded without a commission on buy and sell transactions made online in a. Learn about futures trading —from understanding futures contract specs to placing futures trades with our extensive collection of futures articles, videos, and. Charles Schwab is a great broker for do-it-yourself investors and traders, as well No cryptocurrency trading. Poor ratings on its Android mobile app. No. Cryptocurrencies: Should You Invest in Them? by Schwab Center for Financial Research of Charles Schwab, 11/18/ Download; Print; Email; Save. What is crypto? Learn more about what cryptocurrency is, how it's valued, how it works, and who oversees bitcoin and other cryptocurrency. The US Securities and Exchange Commission has denied many proposed ETFs seeking to hold physical bitcoin. “For investors who are interested in cryptocurrency. Highlights · Low-cost fund offering intra-day trading and potential tax efficiency · Serves as a complement/diversifier to core exposures. How does one invest in bitcoin on the Schwab platform? Can you buy a bitcoin or is there mutual funds or ETF for bitcoin? trading platforms on the market. Screen shot of Charles app While Charles Schwab offers most investment options, cryptocurrency isn't one of them. ETFs at Charles Schwab & Co., Inc. ("Schwab") which are U.S. exchange-listed can be traded without a commission on buy and sell transactions made online in a. Learn about futures trading —from understanding futures contract specs to placing futures trades with our extensive collection of futures articles, videos, and. Charles Schwab is a great broker for do-it-yourself investors and traders, as well No cryptocurrency trading. Poor ratings on its Android mobile app. No. Cryptocurrencies: Should You Invest in Them? by Schwab Center for Financial Research of Charles Schwab, 11/18/ Download; Print; Email; Save. What is crypto? Learn more about what cryptocurrency is, how it's valued, how it works, and who oversees bitcoin and other cryptocurrency. The US Securities and Exchange Commission has denied many proposed ETFs seeking to hold physical bitcoin. “For investors who are interested in cryptocurrency. Highlights · Low-cost fund offering intra-day trading and potential tax efficiency · Serves as a complement/diversifier to core exposures.

Introducing Schwab Trading Powered by Ameritrade™. Get ready to trade brilliantly. We've combined the strengths of Schwab and Ameritrade to create a world-. Schwab Charitable Fund has entered into service agreements with certain subsidiaries of The Charles Schwab Corporation. © Schwab Charitable Fund. All. cryptocurrency is expected to be trading in the future. Sponsored Content Dianomi Schwab Crypto Thematic ETF. (Image credit: Courtesy of Charles Schwab). Multinational financial services giant Charles Schwab has just submitted filings for a new crypto-related exchange-traded fund (ETF). Trading is scheduled to start July 23 in the second cryptocurrency-based ETF product cleared by the SEC—but investors should continue to proceed with caution. There's GBTC (derives value/intends to track BTC), BITO (Bitcoin futures ETF), and /MBT and /MET (micro bitcoin/ethereum futures). The key note. Cryptocurrency · More Investment Products. Banking & Borrowing. Overview; Bank Trading Fees and Commissions. Online Trades; Broker-Assisted Trades. Listed. The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc. YUX. Its founding investors, which include major traditional firms like Charles Schwab, Citadel Securities, Fidelity Digital Assets and Sequoia Capital, alongside. Schwab Asset Management® is the dba name for Charles Schwab Investment Management, Inc., the investment adviser for Schwab Funds, Schwab ETFs, and separately. Virtual currencies can result in real tax liabilities. Discover how cryptocurrencies are taxed and how to avoid running afoul of the IRS. Overview: Best brokers for cryptocurrency trading in September · Robinhood · Interactive Brokers · Webull · activepr.online · Coinbase · Kraken · Charles Schwab. No, As of now, Charles Schwab does not offer direct cryptocurrency trading or purchasing options. However, the company has expressed. Charles Schwab (SCHW), Citadel Securities, and Fidelity Digital Assets announced the start of cryptocurrency exchange EDX Markets. Unlisted ETFs are subject to a commission. Trade orders placed through a broker will receive the negotiated broker-assisted rate. An exchange process fee. Charles Schwab & Co., Inc. (Schwab) which are US exchange-listed can be traded without a commission on buy and sell transactions made online in a Schwab. trading and managing your cryptocurrency investments. Bitget provides Is it possible to purchase cryptocurrency through Charles Schwab? Three of the largest traditional finance institutions have launched a noncustodial #bitcoin and #cryptocurrency exchange amidst #regulatory. Learn how to invest in Bitcoin using Charles Schwab through ETFs, related stocks, and indirect funds Schwab trading platform. Does. Robinhood offers fewer account types than Schwab, but it caters to beginner investors and allows you to trade crypto. Read our comparison to make the right.

Nfts And How To Make Money

NFT Art, was what brought NFTs to the forefront in and into the more general public's awareness, namely when an NFT artist by the name of Beeple sold a. Few ways to use NFTs to generate income · 1. Create and sell your own NFTs · 2. Trade NFTs · 3. NFT staking · 4. Investing in NFT startups · 5. NFT gaming · 6. NFT. If you're not a creator and you're wondering how you can jump in and make money from NFTs, you can: flip collectibles, loan NFTs, or create a fractional NFT. "Strategizing Success: Unveiling Expert Insights · Educate Yourself: Start by educating yourself about NFTs. · Identify Your Niche: NFTs cover. Make money selling fashion as NFT. Sell Fashion Pieces as NFTs: The fashion industry has also embraced NFTs, creating a new avenue for income. If you're a. NFTs became popular through digital art, and many collectors still buy NFT art and collectibles more than music. Most NFT marketplaces were also built for. Turning NFTs into a Profitable Machine · 1. Leveraging Social Media and Marketing · 2. Creating Utility for NFT Holders · 3. Dynamic Pricing. Non-fungible tokens (NFTs) can be bought from marketplaces like OpenSea, Binance, and Magic Eden. · NFTs transfer ownership of an item from one entity to another. Buying NFTs can still be a lucrative venture. In reality, there's no real magic to making money with NFTs. The value of a NFT is solely dependent on supply and. NFT Art, was what brought NFTs to the forefront in and into the more general public's awareness, namely when an NFT artist by the name of Beeple sold a. Few ways to use NFTs to generate income · 1. Create and sell your own NFTs · 2. Trade NFTs · 3. NFT staking · 4. Investing in NFT startups · 5. NFT gaming · 6. NFT. If you're not a creator and you're wondering how you can jump in and make money from NFTs, you can: flip collectibles, loan NFTs, or create a fractional NFT. "Strategizing Success: Unveiling Expert Insights · Educate Yourself: Start by educating yourself about NFTs. · Identify Your Niche: NFTs cover. Make money selling fashion as NFT. Sell Fashion Pieces as NFTs: The fashion industry has also embraced NFTs, creating a new avenue for income. If you're a. NFTs became popular through digital art, and many collectors still buy NFT art and collectibles more than music. Most NFT marketplaces were also built for. Turning NFTs into a Profitable Machine · 1. Leveraging Social Media and Marketing · 2. Creating Utility for NFT Holders · 3. Dynamic Pricing. Non-fungible tokens (NFTs) can be bought from marketplaces like OpenSea, Binance, and Magic Eden. · NFTs transfer ownership of an item from one entity to another. Buying NFTs can still be a lucrative venture. In reality, there's no real magic to making money with NFTs. The value of a NFT is solely dependent on supply and.

Another way to make money with NFTs is by buying them from other players. In addition to reselling, you can also sell them to other users. For example, a. The Simplest Way? Buy An NFT That Generates Passive Income! There are a number of NFT projects that exist that have different ways for their owners to earn. About this ebook. This eBook will cover all you need to know about NFT and will answer questions like what is an NFT, why people buy NFTs, how to create your. This is a really simple method to create and sell an NFT on a marketplace without having to set up wallets or any of this other complicated stuff. You can. How do I leverage NFTs for profit? · 1. Creating and Selling Unique Digital Art · 2. Launching Exclusive NFT Collections · 3. Exploring Virtual. One of the best ways to make money with NFTs is to use them to earn passive income. There are a few different ways you can do this. One way is to create and. Want to make money off NFTs? There are a few ways to do so. Read this article for helpful tips on NFT creation, marketing, and trading. Unlike traditional platforms, an NFT does not lose value if it sells multiple copies. Instead, artists earn a royalty fee every time their artwork is sold on. Flipping NFTs comes down to a basic process. You need a Web3-suitable wallet like Metamask or Trust Wallet. As for selling, it's essential to know what and when. The most obvious way for them to make money is to sell their NFTs on various NFT marketplaces. There are many solutions and tools that allow creators to mint. How to Make Money Selling Art using NFTs · 1. Create Digital Art The first step is to create your digital art. · 2. Create a Crypto Wallet Account Next, you'll. How to Make Money Selling Art using NFTs · 1. Create Digital Art The first step is to create your digital art. · 2. Create a Crypto Wallet Account Next, you'll. Get your wallet: You'll need to download a crypto wallet which is where you store your digital funds. Buy your cryptocurrencies: Most NFTs exist on the Ethereum. One effective way to make money with NFT is to implement play-to-earn games. Most of the games in the NFT industry need a good upfront investment to participate. Top 5 Easiest Ways to Make Money Online with NFTs · 1. Create & Sell NFTs. Your creativity can easily be turned into money via NFTs. · 2. Rent out NFTs. It is. Create and Sell NFTs: One of the most common ways to make money with NFTs is to create your own and sell them. You can create digital art, music. The sale prices of NFTs are rising as they gain in popularity. Consequently, NFT creators can make a lot of money. However, not all NFTs will even sell, let. Want to make money off NFTs? There are a few ways to do so. Read this article for helpful tips on NFT creation, marketing, and trading. Another popular technique to create passive revenue with NFTs is staking. It entails storing monies in a virtual wallet and using them as collateral for a.

Invest In Insurance Policies

Investments, real estate, business interests and other investment assets can vary in value over time. A life insurance policy provides predictability. Life. The two main components that make up a life insurance policy are the death benefit and the cash value. The death benefit is the part of the plan that the. Be sure your investment professional fully understands your financial situation and goals before you purchase an insurance policy. And don't forget to consider. Have coverage that lasts your whole life2 and gives you more flexibility now and down the road—letting you change your payment amount (premiums) and schedule4. There may be limitations on how the cash value can be invested within a life insurance policy and the specific investment choices available may depend on the. There are distinct investment-insurance plans, such as the Unit Linked Insurance Plan (ULIP) for the clients, offering dual benefits. One portion of the premium. Learn what kinds of insurance policies or other investment products can meet your needs. Consider whether you can afford the policy. The fees and expenses. Term plans may be "convertible" to a permanent plan of insurance. The coverage can be "level" providing the same benefit until the policy expires or you can. Whether life insurance is a good investment for you depends on your finances, as well as the duration of coverage needed. · Term life insurance can make sense if. Investments, real estate, business interests and other investment assets can vary in value over time. A life insurance policy provides predictability. Life. The two main components that make up a life insurance policy are the death benefit and the cash value. The death benefit is the part of the plan that the. Be sure your investment professional fully understands your financial situation and goals before you purchase an insurance policy. And don't forget to consider. Have coverage that lasts your whole life2 and gives you more flexibility now and down the road—letting you change your payment amount (premiums) and schedule4. There may be limitations on how the cash value can be invested within a life insurance policy and the specific investment choices available may depend on the. There are distinct investment-insurance plans, such as the Unit Linked Insurance Plan (ULIP) for the clients, offering dual benefits. One portion of the premium. Learn what kinds of insurance policies or other investment products can meet your needs. Consider whether you can afford the policy. The fees and expenses. Term plans may be "convertible" to a permanent plan of insurance. The coverage can be "level" providing the same benefit until the policy expires or you can. Whether life insurance is a good investment for you depends on your finances, as well as the duration of coverage needed. · Term life insurance can make sense if.

The insurer invests a portion of your premiums. The return on the investment is credited to your policy tax-deferred. Universal life insurance offers a. Investment options from insurance companies also tend to be front loaded with fees that kneecap your returns in comparison to DIY by just. What is the process for getting a whole life insurance policy? · Analyze. During your initial phone call, your financial professional will ask you questions to. One way companies make sure they can cover all the payouts is to charge higher premiums for these policies. Companies also use the underwriting process to. A permanent life insurance policy can build wealth for the future. But it's not the only type of life insurance to consider. (a) A life insurance company that, before August 28, , issued or assumed the obligations of policies or annuity contracts that were registered as provided. Contract provisions and investment options vary by state. Annuities are Guardian® is a registered trademark of The Guardian Life Insurance Company of America. It will be a little wrong to call insurance policies an investment vehicle. But yes, if we specifically talk about market linked products, Unit. There's the cost of the insurance protection itself - which, by the way, is usually more expensive than what you would pay for a regular term insurance policy. Investing in life insurance offers a dual purpose. It offers financial protection but also helps you achieve long-term financial goals. Life insurance policies. A viatical settlement allows you to invest in another person's life insurance policy. With a viatical settlement, you purchase the policy (or part of it) at a. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency. In the former case, the insured party's premium is used by the company to subscribe to specialised funds on the stocks, bonds or balanced funds markets. Investment insurance is a financial product that combines the benefits of both insurance and investment. A ULIP can be considered an investment insurance. Life insurers invest premiums that they receive from customers. They SNL Life Insurance stock index over the. to period. This loss is. (Some policies offer a low guaranteed rate over a longer period.) Other investment vehicles use market indexes as a benchmark for performance. Their goal. With some policies, some of the money you pay for premiums earns interest, which creates a fund you may be able to use while you're still alive. That's the cash. John Hancock Vitality Program rewards and discounts are available only to the person insured under the eligible life insurance policy, may vary based on the. Many policyholders also use life insurance as a tax-advantaged way to help supplement their other savings plans, investments, and retirement accounts. Many policyholders also use life insurance as a tax-advantaged way to help supplement their other savings plans, investments, and retirement accounts.